With vehicle ownership costs historically high, how might insurance help consumers and dealers alike? Uncover more trends in our 2025 Embedded Auto Insurance Study.

THE 2025 POLLY EMBEDDED AUTO INSURANCE STUDY

The latest consumer trends and preferences in embedded insurance within the car buying process.

As the Cost of Car Ownership Stabilizes, New Consumer Buying Trends Emerge

The cost to own a car remains at an all-time high despite leveling out in 2024, and it’s changing the way car buyers shop. Buyers are prioritizing affordability and looking harder at long-term expenses, making embedded insurance and financial products more relevant than ever.

We found that the average annual insurance premium flattened out in 2024 as well, to an average of $198 a month. Yes, the average quote in 2024 is still up 9.2% from the previous year. However, it has remained relatively steady over the last four quarters, increasing by only 3% over the course of the year.

» How Can Dealers Take Advantage of These Trends?

» How Can Dealers Take Advantage of These Trends?

With vehicle ownership costs historically high, how might insurance help consumers and dealers alike? Uncover more trends in our 2025 Embedded Auto Insurance Study.

Insurance Premiums Spark Unprecedented Rate Shopping

Insurance premiums hit record levels over the last two years, motivating car buyers to explore insurance options at the dealership. That’s an opportunity for dealerships to introduce competitive insurance options to help close cost-sensitive buyers.

69% of Millennials and Gen Z buyers said they would buy a nicer vehicle or upgrade their vehicle if they could save while in the dealership. This insight represents a huge untapped income opportunity for many dealers.

» Can Insurance in the Dealership Help Sell More Cars?

It’s true that premiums have risen to unprecedented levels. What’s also true is that auto insurance can be a deal maker and even a deal sweetener. Download our 2025 Embedded Auto Insurance Study to learn how it works.

» Can Insurance in the Dealership Help Sell More Cars?

It’s true that premiums have risen to unprecedented levels. What’s also true is that auto insurance can be a deal maker and even a deal sweetener. Download our 2025 Embedded Auto Insurance Study to learn how it works.

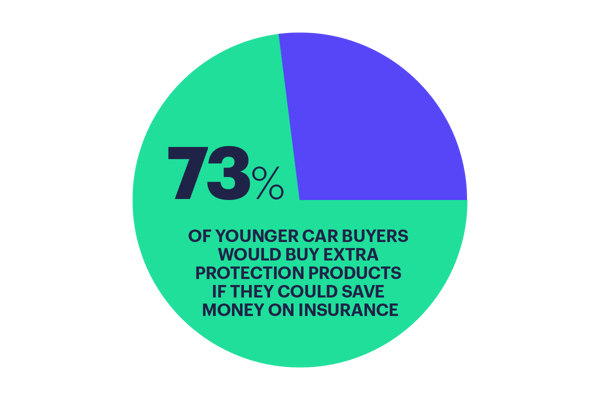

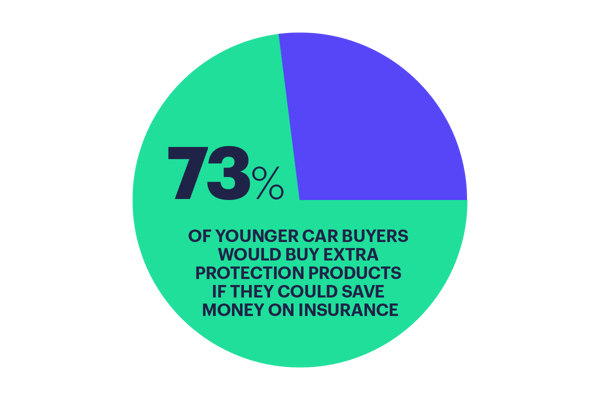

Embedded Insurance and Higher F&I Gross: The Connection is Clear

Dealerships that successfully integrate insurance into the car buying experience capture more F&I income, especially when car buyers switch and save on insurance.

73% of younger car buyers would buy extra protection products if they could save money on insurance.

» Could Insurance Unlock Higher F&I Profits?

Download the Polly 2025 Embedded Auto Insurance Study and see why 73% of young buyers are ready to spend more when saving on insurance.

» Could Insurance Unlock Higher F&I Profits?

Download the Polly 2025 Embedded Auto Insurance Study and see why 73% of young buyers are ready to spend more when saving on insurance.

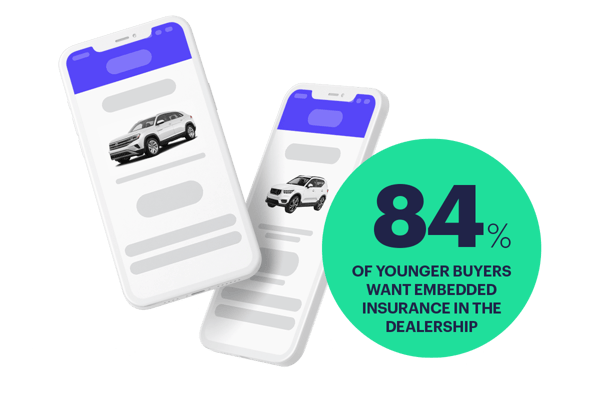

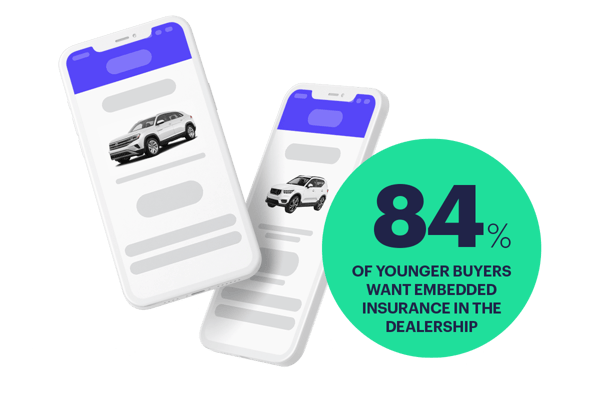

Embedded Insurance is Essential to Dealership Loyalty and Satisfaction

Today’s car buyers expect embedded insurance as part of their purchase journey. Dealers that meet this expectation see stronger satisfaction ratings, more referrals, and higher return rates.

84% of younger car buyers want embedded insurance in the dealership. Embedded insurance is a loyalty booster. Millennials and Gen Z said they would feel better about their dealership experience if it included an embedded auto insurance solution.

» A Surprising Connection Between Insurance and Buyer Loyalty?

Embedded insurance isn’t optional anymore. In fact, car buyers are displaying more dealership loyalty to dealers who provide a complete deal, including insurance. Get the Polly 2025 Embedded Auto Insurance Study and find out more.

» A Surprising Connection Between Insurance and Buyer Loyalty?

Embedded insurance isn’t optional anymore. In fact, car buyers are displaying more dealership loyalty to dealers who provide a complete deal, including insurance. Get the Polly 2025 Embedded Auto Insurance Study and find out more.

Methodology

Polly conducted a survey of 1,023 Americans 18 and over who had purchased a car at a franchise dealership within the last 12 months.

The survey, facilitated by Centiment, took place between September 25-30, 2024.

The survey explored recent car buyers experiences, expectations, feelings, and desires within the current socio-economic landscape.

In addition, Polly incorporated first-party data and analytics as well as trusted third-party data to complete this study.