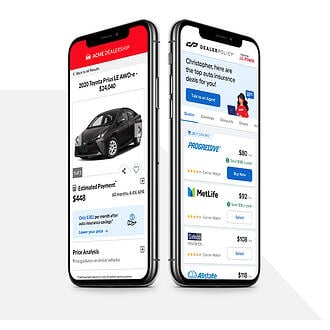

Integration with DealerPolicy’s New FastPass API Delivers Customer Savings Opportunities and Additional F&I Revenue for Dealers

BURLINGTON, VT (November 11th, 2020) – DealerPolicy, the leading insurance marketplace solution for dealers, and FRIKINtech, a leading auto retail desking and CRM tool provider, have teamed up to provide online car shoppers with a better experience. FRINKINtech has integrated with DealerPolicy’s FastPass™ API allowing them to offer customers access to DealerPolicy Insurance while they shop for a car. Leveraging the technology of DealerPolicy’s FastPass mobile solution, the integration allows customers to compare insurance rates for the car of their interest and seamlessly buy insurance during the car-buying process.

“For car buyers, this new solution lends a more holistic picture of the overall monthly vehicle cost representing the two largest expenses side by side – auto insurance and the vehicle payment,” says Travis Fitzgerald, CEO of DealerPolicy. “When customers save money on auto insurance, they often realize that also increases their spending power as a result. Those extra dollars can be reinvested back into other value-add F&I products or services offered by the dealer.”

The API FRIKINtech is accessing was developed off DealerPolicy’s proprietary customer experience, FastPass, which is a simple and intuitive way to shop and buy auto insurance online. Its proprietary one-touch questionnaire and aggregate of prefill solutions from leading data providers produces multiple insurance quotes to present to customers and connects them to a licensed insurance agent instantly. The integration of J.D. Power’s Intelligent Match platform adds a scoring value to each FastPass quote based on shoppers’ personal preferences, increasing the overall buying experience with a new degree of accuracy and efficiency.

Alex Snyder of FRIKINtech reports that dealers also win with the integration: “Not only are car buyers getting a more complete picture of the cost to purchase, but the integration passes back valuable data to our dealers on the customer’s insurance savings and trade-ins, giving them a much better sense of a customer’s available budget.”

The majority of DealerPolicy Insurance customers save an average of $63 per month, or $762 per year. Those savings translate into an additional $3,694 of buying power when financing a car, which is often put toward F&I products. Dealers in DealerPolicy’s network report an average increase of 34 percent in their back-end gross sales for deals where the customer also purchased an insurance policy through DealerPolicy Insurance.

The new FastPass API is available now to digital retailers and automotive vendors. Details can be found at https://www.dealerpolicy.com/fastpass-api. For more information on integrating the FastPass API, please email rfitzgerald@dealerpolicy.com.

About DealerPolicy

DealerPolicy is the most trusted and complete digital insurance marketplace for automotive retailers and their valued customers. The company’s innovative mobile technology enables car-buyers to view multiple insurance quotes and immediately connect with licensed insurance agents to purchase insurance. With an exclusive combination of partnerships among premier automotive retailers and data providers, an industry-best insurance carrier network, and access to DealerPolicy Insurance licensed agents, DealerPolicy is recognized for its place at the forefront of Insurtech. DealerPolicy Insurance is a licensed insurance agency, with licenses to operate in the lower 48 states. For more information, visit www.dealerpolicy.com.

Polly

Polly is on a mission to offer people a better way to buy insurance, by embedding it into life’s biggest, most important purchases, like a car or a home. Instead of having to buy a car in one place and insurance in another, Polly embeds 30+ top insurance choices into the car-buying process. Get insurance options from...