.png?width=960&height=384&name=Polly_Signals_PCMarket_BlogChart%20(1).png)

A little background on 2023

It’s no secret that the insurance market in 2023 has been extremely difficult. In business terminology, it’s known as a hardened market. Insurance carriers raised their rates, and they became less willing to take on new customers. The first is easy to explain in a single word: inflation. The cost to insure and repair vehicles, as well as the cost to cover medical expenses, rose dramatically. If insurance carriers didn’t raise their rates, they would be operating at a loss and depleting surplus (the funds that remain after a carrier sets aside its loss reserves, which are used to cover its liabilities).

The second issue (turning away new business) is one that many outside the industry aren’t familiar with. Here’s why it happened: each state must approve a carrier’s proposed premium increase. Between the time it takes to request the increase, and the time it is approved, the carrier is unwilling to take on new customers because the company would simply lose money on mispriced business. Most of the time, even in a good year, insurance carriers don’t make money on a policy immediately. In fact, it can take several years to break even on a sold policy; thus, when rates on new business aren’t adequately covering the risk to the carrier, it puts even more pressure on their ability to turn a profit.

Some carriers are quicker than others to update their base rates and present to each state’s department of insurance for approval; some states are quicker and more receptive to the requests than others. It all made for a messy landscape this year.

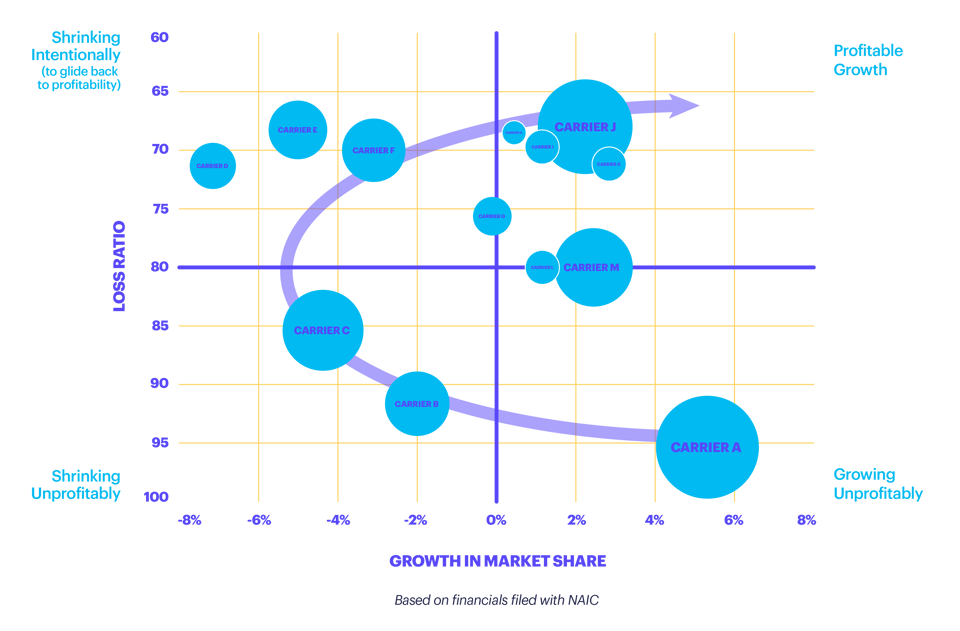

Here's a quick overview of the current state of the insurance market that explains why carriers turn off the spigot to new business in a hard market. Carriers that find themselves with mispriced business want to move from the lower right-hand quadrant into the upper right-hand quadrant. But to move from unprofitable to profitable, they need to move through the other quadrants first. You’ll notice some carriers have moved into the right-hand quadrant already, while others are still making their way there.

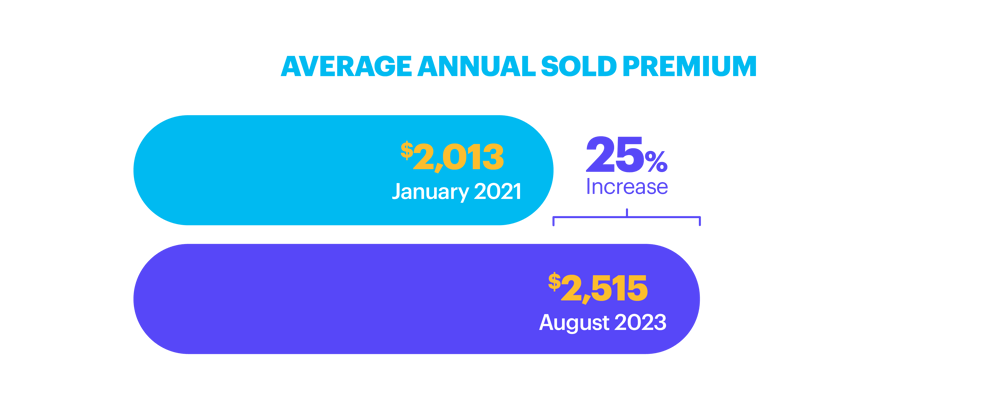

The effect of the hardened market on the consumer this year was stark. Our own data shows that the average annual sold premium cost went from $2,013 in January of 2021 to $2,515 in August of 2023; that’s a 25% increase and indicative of what was happening across the entire industry.

Polly’s Response

We’ve worked hand in hand with our carriers to offer everything we could to our customers and potential customers. I consider Polly’s incredibly close and strong relationships with carriers to be a differentiator for us; based on their feedback and insight, we’re able to optimize what our customers have access to. And although we certainly saw a reduction in the number of quotes provided to a given shopper, in many cases, potential customers still saw more options than they did with other insurance companies.

We also worked with our existing customers to re-shop them as their policies came up for renewal. In some instances, we were able to help them find a lower priced policy with a different carrier.

Perhaps the biggest thing we did in 2023 was to actively work on expanding our carrier base. With 40+ carriers, we already have an industry-leading panel, but if this year taught us anything, it’s that the strength and depth of your carrier partnerships is critical to running a successful insurance business. I’m pleased with the progress we’ve made in this area; we have several new carriers we expect to on-board very soon. For customers, that will mean more competition, more options, and more potential savings.

Why I’m Optimistic Heading into 2024

Here’s the good news: things are looking brighter for 2024. Why? There are two signals that are pointing to a stabilization in the market.

- In most cases, carriers have updated their base rates and started the process of filing these increases with the various state regulators. As these filings work their way through the system, carriers will begin to feel more rate adequate and look to resume writing a healthy flow of new business again.

- While I don’t have a crystal ball, it appears that inflation is beginning to ease, which means that the costs that factor into insurance premiums will start to normalize at a more predictable inflationary trend. Provided things stay on track, we shouldn’t see carriers scrambling to reset rates the way we did this year.

One piece of the puzzle in the property and casualty insurance space that we won’t know until December is how the hurricane season nets out. So far, while there have been several named storms, we haven’t seen the kind of destruction that causes massive claims. If this continues to be the case, then it will provide carriers additional time to build up their reserves without needing to resort to additional, unexpected premium increases.

An important caveat is that I expect that the market will turn gradually in 2024, not all at once at the start of the year. Some carriers will be ready before others. The ones in the upper right-hand quadrant of the chart shown earlier are the ones most likely to accept new customers first. Carriers will open for business on a state-by-state basis, as they shift their focus from profitability to growth, partially based on the conditions of each state (conditions usually meaning the regulatory environment and whether it is more or less favorable to achieving profitability). Organizations like Polly, which have very strong carrier relationships will be best positioned to benefit from the softening market and to pass those benefits on to their customers and partners.

How you’ll know the recovery is happening

You’ll see more advertising. You may not have noticed, but in keeping with their desire to minimize new business, a lot of carriers decreased their advertising this year. As they get more interested in taking on new customers, you’ll see carriers start to spend more on their marketing. So, if you start to see a lot more insurance marketing while you’re watching TV or surfing the web, it’s a good sign that carriers are starting to open their doors again.

Most importantly, however, you’ll see it when you shop for insurance. This year, as always, we kept close track of how many quotes potential customers saw in our marketplace when they were shopping. We saw the number of quotes decline in 2023 as carriers became less eager to quote new customers, but in 2024, as carriers open back up, we expect to see more and more quotes produced, giving customers more and more options.

The effect on consumers

As carriers start to feel their new business rates are adequate, they’ll want to start writing new business again. And, in doing so, the market will gradually soften with carriers lifting their new business restrictions, giving customers a more competitive market to choose the carrier that best fits their needs. And with more options available, customers may find savings by switching to a new carrier.

It's also important to remember that not every customer is exclusively focused on price when it comes to purchasing insurance; factors like customer service and claims handling are still very important considerations in the insurance buying process. Again, with more options to select from, the customer is more likely to be able to find the policy and the carrier that fits their needs best.

The effect on the wider ecosystem

As the insurance industry recovers, we’ll see positive effects across the wider ecosystem, including for our partners, such as the dealerships in our network. With more insurance options becoming available, there will be more and more customers who see savings, relative to the overall market, by shopping their policy around while they are purchasing their car. This reduction in the overall cost of car ownership will be welcome news for the customer. In many cases, it may allow the customer to afford a nicer car, some add-ons, or dealer provided protection products that might not previously have been within budget. This has positive implications not only for the customer, but also for the dealer.

How dealers can prepare for the coming recovery

There are several things dealers can do to maximize the benefits of the improving insurance market. The first thing is to use a holistic insurance solution in your dealership. For you and your customers to benefit the most, it makes sense to ensure that insurance is woven into the ecosystem of your car buyers’ journey. Every year, customers demand more and more efficiency and ease from their buying process. If you don’t have a solution for them in place, you’ll find that your competition does.

But let’s assume that you do have something in place. What are the things you can do to position yourself to take advantage of the coming recovery? Here are my top three suggestions:

- Prepare your team. Let them know that the recovery is coming, and that in 2024, they should ensure that their customers are aware of their insurance options, particularly if they are able to conveniently shop in a marketplace. Doing so can save deals, or potentially allow your F&I Manager to help a customer get additional products.

- Put out showroom materials that reference insurance. Don’t leave an in-store conversation up to chance. If your customer might be able to shop their insurance policy and in so doing, open up further budget for their car, you’ll want to ensure that there are some reminders on hand to prompt them to do so.

- Optimize your digital showroom. Give your potential customers a way to shop for insurance while they’re doing their initial online research on your website, or in your other owned, digital channels (such as your VDP gallery). This allows the customer to factor in the total cost of ownership. If they see that they can save by moving to another carrier, it may mean that they consider a higher-end vehicle.

This year was undoubtedly a difficult one for our insurance partners, but we’re looking toward 2024 with optimism. As the insurance market gradually rebounds, we will continue to stand by our partners and customers to help everyone reap the rewards of the recovery.

Tom Lyons

As Polly’s President & Chief Operating Officer of Insurance, Tom is responsible for Polly’s insurance platform, agency distribution, book performance, written premium, revenue, earning recognition, sales and service. He also oversees operations, underwriting, and analytics. Prior to joining Polly, Tom was with...